HOMELEND

Homelend is a Blockchain platform that was developed to simplify mortgage origination. This platform is expected to turn it into a simpler, more efficient and fair process. It intends to achieve this by reducing the distance between the borrower and the lender. Basically, this is a mortgage loan platform. How exactly does it work, you ask?

Platform principles:

Homelend connects potential lenders, who can become individuals, and borrowers, when using automatic blocking protocols and smart smart contracts, without intermediaries and bank fees. This platform sometimes simplifies and makes it possible to get loans for solvent people who, for whatever reason, cannot get approval from the bank, and also provide a platform for profitable investments to lenders.

The Homelend Advantage

Efficient & Efficient

By embedding the predetermined business logic into a smart contract, digitizing documentation and eliminating unnecessary processes, Homelend will automatically carry out the end-to-end origination process, cutting it from 50 days to less than 20.

Transparent & User-Friendly

Homelend aims to create a loan process that is not only smart, but also simple and fair. This will allow the borrower to easily apply for a loan, track the status of their application at any time and interact directly with the mortgage lender.

Cost-Effective & Free-Middleman

The persistence, security and transparency provided by DLT makes it possible to record transactions, including loans, without banks acting as intermediaries. This will reduce costs for borrowers and lenders, while minimizing the distance between them.

Trusted & Safe

Centralization and paper-based processes are key factors behind the insecurities and vulnerabilities that characterize the traditional mortgage industry. The unique characteristics of DLT and smart contracts enable Homelend to provide a platform for people to transact large amounts of money in a trusted, transparent and safe way

In addition there are many things offered by Homelend on the Official Website and detailed information please read the white book or see the video below. To enjoy the benefits offered by Homelend, please participate in the ICO / TGE Homelend.

Token Generation Event (THE)

These tokens, called "Homeland tokens" and identified as HMD tokens, will be the fuel of the P2P loan platform. Detailed information is below.

- Token Name: HMD

- Price of 1 ETH: 1,600 HMD

- Platform: Ethereum

- Receive: BTC, ETH, Fiat

- Minimum investment: 1,000 USD

- Soft stamp: 5,000,000 USD

- Hard cap: 30,000,000 USD

- Country: Switzerland

- Whitelist / KYC: KYC & Whitelist

TOKEN DISTRIBUTION

As said before, 50 Million HMD will be saved as a backup. That means 200 Million HMD will be distributed. According to the whitepaper, this is the way.

The largest percentage of tokens, about 36 percent (90 million HMD) will be used for public TGE sales. This will happen after 28 percent (70 Million HMD) must have been used for pre-sales.

The founding team is expected to receive 8 percent (20 million HMD) tokens and another 8 percent will be given to advisors and gift services.

DISCOUNT INCENTIVE

Of course, there is a bonus incentive for the nominal value of HMD tokens during presale. Also, discount incentives will be offered during public sales. However, this depends entirely on the time to purchase the token.

ROADMAP

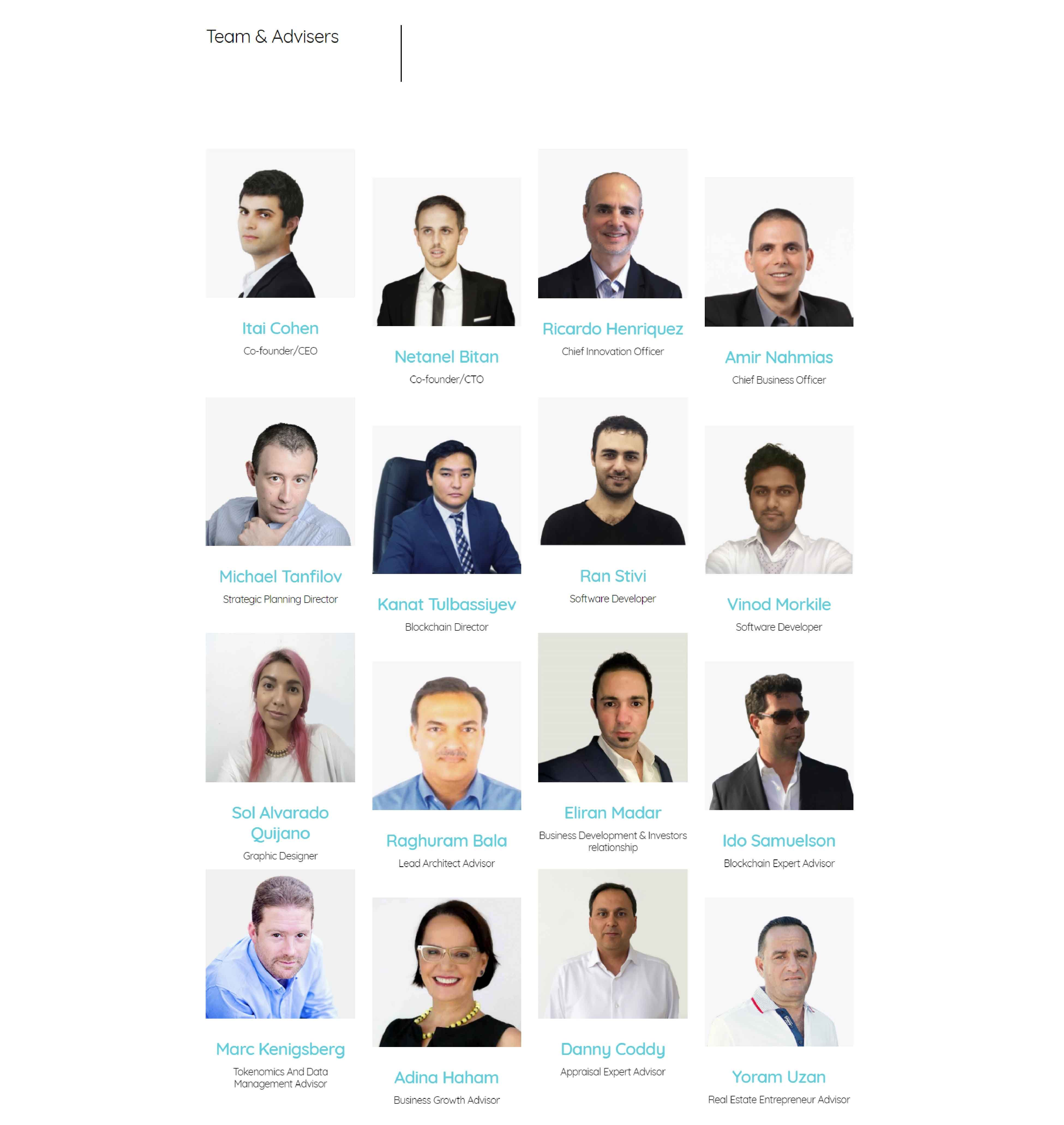

TEAM

FOR MORE INFORMATION :

WEB SITE: https://homelend.io/

WHITEPAPER: https://homelend.io/files/Whitepaper.pdf

FACEBOOK: https://www.facebook.com/HMDHomelend/

TWITTER: https://twitter.com/homelendhmd

TELEGRAM: https://t.me/HomelendPlatform/

Author: pecandukopi

bitcointalk: https://bitcointalk.org/index.php?action=profile;u=1979336

eth: 0xB8Fb41E1141E4670EA3A5513D85f1b4F03707DEF

Komentar

Posting Komentar